Company Compliance Checklist: Conquer Tax-Time Chaos

Tax season shouldn’t steamroll your calendar. A tight checklist keeps filings on time, numbers defensible, and auditors a bit drowsy. Park the steps below on a recurring schedule so April 15 lands without drama.

Map every deadline and assign an owner

List federal, state, and city filings, set due dates, and name the person responsible. Include payment fallbacks if cash gets tight; IRS installment plans and tax debt loans can cover a gap without missing payroll. An S corporation in Denver blocks March 15 for Form 1120-S and shareholder K-1s, and marks April, June, September, and January 15 for estimated payments.

Make sure your entity info is current with the state

Check the legal name, principal address, and registered agent on file with the Secretary of State, and submit any annual report that’s due. A Delaware C corporation that relocated to Austin updates its address first, so IRS letters don’t keep landing at an old WeWork mailbox.

Reconcile the books before you calculate anything

Close the year, tie out bank and card statements, and lock the period. In QuickBooks Online, reconcile December to your Bank of America statements, match Stripe 1099-K totals, and post accruals so gross receipts on the return match what lenders and investors will see.

Make payroll and employment taxes line up

Verify that Forms 941, 940, W-2, and state filings went in and were paid. A Los Angeles employer reviews California EDD deposits, confirms FUTA on Form 940, and ties the W-3 totals to the payroll register, which surfaces a missing December bonus before it distorts Box 1 wages.

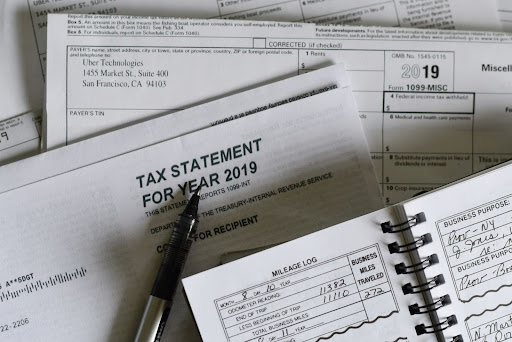

Gather W-9s and send 1099-NEC on time

Collect taxpayer IDs from contractors, apply backup withholding when required, and e-file by January 31. A Houston marketing shop that paid a designer $3,200 by ACH files through the IRS IRIS portal and skips the late-filing penalties that pile up fast.

Confirm where you owe sales tax and file there

Figure out where you have economic nexus, register, then collect and remit. Since South Dakota v. Wayfair, a Shopify seller with 220 Illinois orders and $120,000 in sales signs up with the Illinois Department of Revenue and files on time, rather than betting Chicago will look the other way.

Document deductions and any credits you plan to claim

Keep invoices, elections, and support that connects to the return. A Raleigh software startup elects Section 179 on an $18,000 Mac Pro and files Form 6765 for the R&D credit, with payroll reports that tie cleanly to the calculation, which keeps an examiner focused on facts, not guesswork.

Plan cash for estimates and year-round obligations

Forecast quarterly estimates and payroll tax deposits so bills don’t collide with rent. A New York C corporation uses Form 1120-W to project four estimates, schedules transfers two business days ahead, and keeps a small line of credit ready for a tight September.

Use extensions correctly when you need more time

File Form 7004 for pass-throughs and corporations or Form 4868 for individuals, and pay what you expect to owe with the extension. An Atlanta partnership extends to September 16, sends a 90 percent safe-harbor payment, and checks the IRS disaster page after a hurricane grants extra time to affected ZIP codes.

Organize records with a simple retention plan

Keep tax returns and supporting documents for at least 7 years, payroll records for 4 years, and corporate minutes for the life of the company. A Milwaukee manufacturer keeps signed returns, bank statements, and depreciation schedules in Google Drive and on an encrypted backup, skipping the shoebox approach that turns audits into archaeology.

Checklists only help if they sit where the work actually happens. Drop due dates on a shared calendar, tag owners in your project tool, and set reminders 10 days in advance. Your future self will nod when April 15 feels like any other Tuesday, not a surprise twist.

Leave a Reply